Vision.

Jorge Guarner

Founder and Executive Chairman

Healthcare Activos has the vocation of becoming a long-term partner for large European healthcare operators, in order to support them in their growth plans and to provide them with the necessary infrastructure to offer their services.

The healthcare industry is expected to attract significant investments in the coming decades as a result of the positive impact it has on the society, both on the well-being and quality of life of people and on local economies, creating high-quality jobs that cannot be relocated.

As a result of the extensive experience of the team in the healthcare sector, Healthcare Activos applies an “operator mindset” to its vision of the industry and the analysis of investments.

Main Figures.

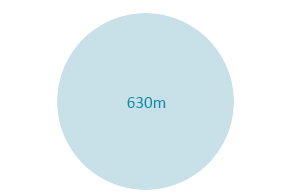

630m

euros of total

investment volume

50

Assets under management

1.9x

Average rent

cover

19

WAULT of the portfolio

(years)

History

Our

history

Since its foundation in 2016, the firm has acquired more than 64 assets, of which 53 are fully operational and 11 are in development phase, with a combined asset value of more than 910 million euros.

Total investment volume evolution

(in millions of euros)

2016

- Foundation of Healthcare Activos

- Creation of Healthcare Activos Investment S.A.

2017

- Healthcare Activos increases its presence in Spain with the incorporation of new centres and continues its expansion

2018

- Creation of Healthcare Activos 2 S.A., the first Healthcare Activos vehicle with a Core strategy

2019

- Creation of Healthcare Activos Yield SOCIMI S.A., Core strategy vehicle, with more than 100 institutional investors, pension funds and family offices

2020

- Healthcare Activos consolidates its position as the leading investment platform in Spain and begins its internationalisation process with its expansion into Portugal

2021

- Healthcare Activos strengthens its shareholder base with the incorporation of leading institutional investors worldwide.

2022

- As part of its ongoing internationalization strategy, Healthcare Activos has added assets in Belgium and increased its assets in Portugal.

- The company establishes a new long-term financing structure.

2023

- Healthcare Activos continues its growth in Europe and achieves a rating of: VERY GOOD, at Moody’s.

Management Team

Experimented

Extensive experience in the acquisition, management, construction

and asset monitoring in the healthcare sector.